Navigating Bad Credit Auto Loans in Calgary

February 04 2026,

Struggling with a low credit rating in Calgary? You are not alone. Past financial hiccups don’t have to sideline your dream. Today's bad credit auto loans Calgary market is more sophisticated and humane, using advanced 2026 risk assessment models that look at your financial picture, not just a number. This blog is your strategy toolkit to navigate bad credit financing, secure reliable vehicles, and transform your auto loan into a powerful tool for rebuilding your financial future.

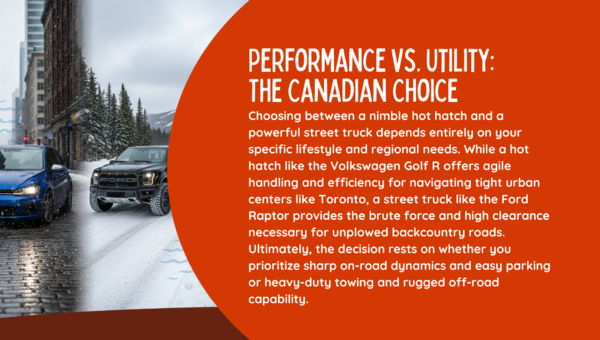

The Evolving Landscape of Bad Credit Financing in Alberta

Gone are the days when a low credit rating meant an automatic 'no' for an auto loan in Calgary. The market has genuinely evolved.

Who This Serves:

- New Canadians building credit

- Individuals with limited credit history

- Individuals recovering from financial setbacks

How do lenders think now?

Lenders today look beyond your score. They focus on your current job stability and overall debt. This holistic approach helps more people get approved for bad credit auto loans in Calgary.

A Word of Caution

This access comes with higher costs. Interest rates for bad-credit financing are sometimes significantly steeper. Always read the terms and budget for the actual total cost of buying a new car.

The future points to more tailored options. Using technology for fair assessments. The goal is clear: provide a path to both vehicles and better credit.

How Lenders Assess Bad Credit Auto Loans Calgary and the Role of Specialists

Wondering how approval works with a low credit rating? Lenders for bad credit auto loans in Calgary dig deeper than you might think. It's not just about the score.

The Credit Deep Dive

They pull reports from Equifax and TransUnion. But they're looking for the story. Is your low credit score from an old issue or recent troubles? Context matters a lot to them.

The Income & Job Stability Check

This is very big. Pay stubs, tax returns, or an employment verification letter can be used to demonstrate steady income. They must verify that you are able to pay off your auto loan in addition to your other bills.

The Debt-to-Income (DTI) Ratio

They calculate your monthly debts against your income. A lower ratio is better. Here's a tip: a solid down payment can really improve your terms. It lowers the loan amount and shows commitment.

The Vehicle & Cosigner Factor

The car itself is collateral. Reliable models are preferred. Also, a cosigner with good credit can be a total game-changer for getting approved.

Who Are The Specialists?

These are the experts, often separate from big banks. Special finance managers at dealerships connect you with lenders who understand bad credit financing. They navigate the complex stuff to find you a workable deal.

Smart Strategies for Your Bad Credit Auto Loan Journey

Getting approved for bad credit auto loans in Calgary requires a smart game plan. Don't just hope for the best—take control. Here’s how to navigate the process successfully, even with a low credit rating.

Start with a Financial Self-Check

Learn your own numbers first. Check your credit reports to find out why your score is so low. Create a reasonable budget after that. Include insurance, gas, and maintenance in addition to the auto loan payment. Knowing what you can truly afford is the most critical step to avoid overextending yourself.

Save for a Strong Down Payment

This is your most powerful move. A larger down payment—aim for 10-20%—lowers the amount you need to borrow. This directly reduces the lender's risk and can lead to a better interest rate on your bad credit financing. It shows you're serious and financially disciplined.

Get Pre-Approval

Never skip this. Use online tools to get pre-approved before you shop. This shows you exactly what you can afford and lets you compare real offers. It often uses a "soft" credit check, so it won't hurt your low credit score. This knowledge puts you in charge when you're ready to buy the cars.

Consider a Cosigner & Choose Wisely

Your terms may be significantly improved by a cosigner with good credit. Be realistic with the car as well. A new model with steep depreciation is frequently less wise than a dependable, reasonably priced used car. This keeps your payments reasonable and the principal lower.

Get Your Documents Ready

Speed up the process by having everything ready: government ID, proof of income (pay stubs, tax returns), proof of address, and your banking details. Being organized makes a great impression.

Best Practices and The Future For Canadian Bad Credit Car Buyers

Securing your bad credit auto loan is one thing: managing it wisely is what leads to real success. Here are the non-negotiable best practices and a look at what’s coming next.

Master Your Total Budget

The monthly auto loan payment is just one aspect of your planning. Really account for fuel maintenance insurance (which may be more expensive if you have a bad credit score) and an emergency repair fund. This comprehensive view safeguards your rebuild plan and avoids overstretching.

Shop and Compare Religiously

Never take the first offer. Use online pre-approval to compare APRs and terms from multiple lenders for a bad-credit car loan in Calgary. Read every word of the contract, understand the total cost of buying a new car, including all fees.

Use the Loan to Rebuild

This is your biggest tool. Set up automatic on-time payments without fail. This positive history gets reported to credit bureaus and is the fastest way to mend a low credit score.

The Future is Personalized

Looking ahead, financing for bad credit is rapidly changing. We are witnessing AI that evaluates more comprehensive financial behavior rather than merely a score, resulting in more equitable terms. Expect more integrated financial literacy support, and as the used EV market grows, more options for buying the cars that fit a greener future.

Conclusion

Let's be honest – navigating bad credit auto loans Calgary with a low credit rating can feel overwhelming. But as we've seen, it's a structured process with a clear goal: getting you reliable transportation while actively repairing your credit. It's a strategic step, not just a last resort.

FAQs

What credit score do I need?

For people with scores below 650, banks can be difficult to deal with. But specialized lenders in Calgary consider all your circumstances, including steady income, rather than just a single figure. Approval scores in the 500s are commonly utilized.

How much down payment is needed?

Aim for 10-25%. A larger down payment is your best leverage. It lowers the loan amount, reduces the lender's risk, and can help you secure a much better rate.

What interest rate will I get?

To be honest, expect higher rates. Rates for poor credit typically range from 15% to 30% whereas good credit receives 5-8%. Your down payment and job security determine your exact rate.

Can this loan help my credit score?

Absolutely, that's the goal. Making every payment on time is reported to the credit bureaus. It's one of the most effective ways to rebuild your credit history.

What documents should I gather?

Have your driver’s license, a recent pay stub or tax notice, a utility bill for proof of address, and your bank details ready. It speeds up the process dramatically.